- #MONEYDANCE VS QUICKEN HOW TO#

- #MONEYDANCE VS QUICKEN ANDROID#

- #MONEYDANCE VS QUICKEN SOFTWARE#

- #MONEYDANCE VS QUICKEN TRIAL#

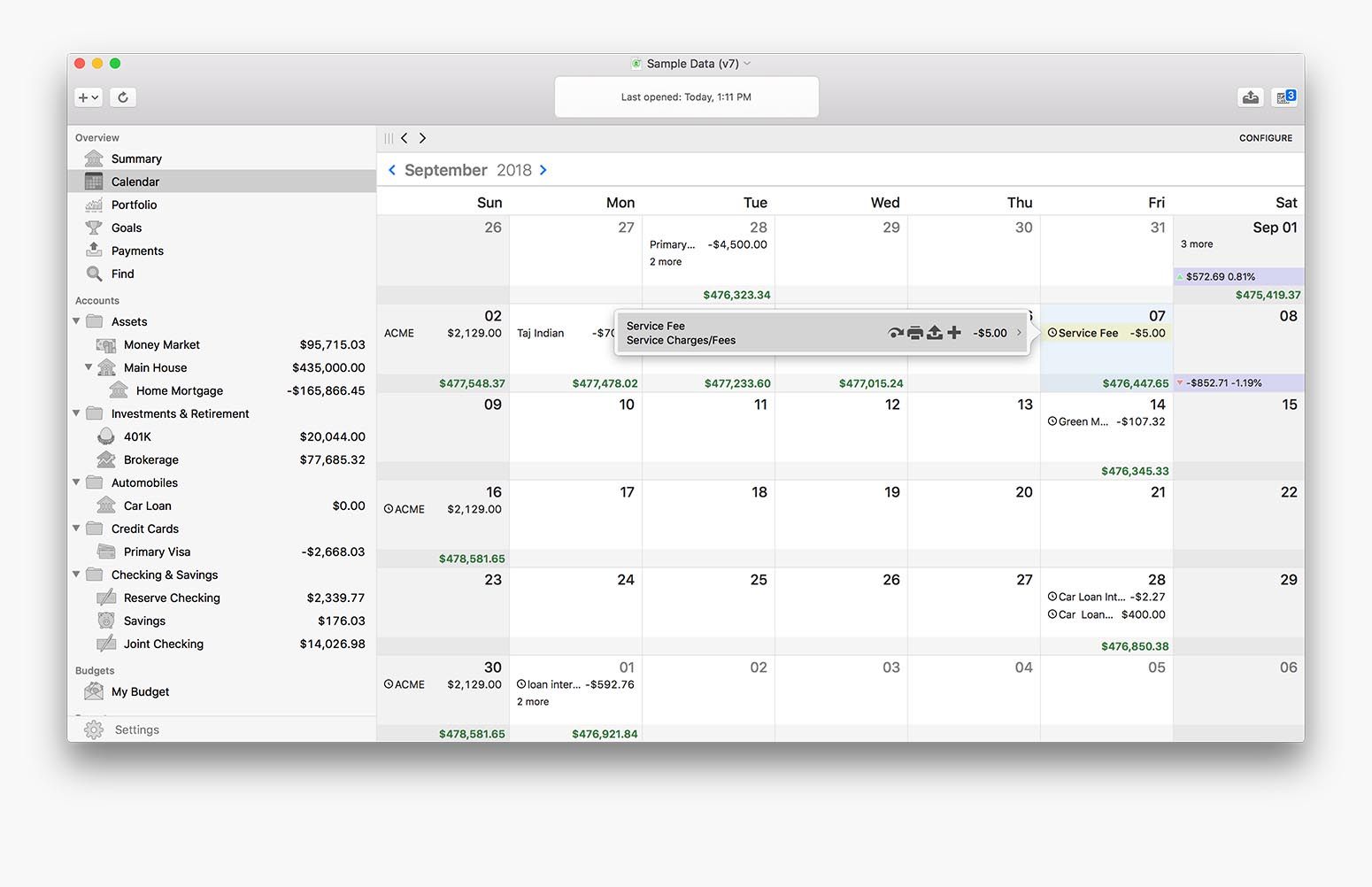

You can also make one-time payments with the software. Online Bill Payment: At the beginning of the month, you can schedule automatic bill pay so you know your bills will be paid on time.This is a great way for you to get a quick view of where you’re at with your spending. Once you start getting closer to the end of your budgeted amount, the graph will turn yellow if you overspend in any area, the graph will turn red. If you haven’t spent anything from a particular category, the category will stay green. Budgeting: Moneydance will show you how you’re doing throughout the month with colored graphs.With Moneydance, you can take advantage of these features: You can import your information from Quicken, although some users have reported that being a difficult process.

#MONEYDANCE VS QUICKEN SOFTWARE#

Once you’ve paid for Moneydance, you can download the software and begin uploading your transactions right away.

#MONEYDANCE VS QUICKEN TRIAL#

You can get started with a free trial of Moneydance, but it will be limited to 100 manually entered transactions. However, there will be periodic upgrades you might want to pay for. There’s no monthly subscription fee and your software won’t stop working after a year. It costs $49.99 to purchase Moneydance and you can use the software for as long as you choose.

#MONEYDANCE VS QUICKEN ANDROID#

The app is available for both iPhone and Android users. The software also comes with a free mobile app so you can keep an eye on your account balances on the go. The software is easy to use and has a number of helpful reporting options. From there, you can track your spending so you always know where you’re at with your budget. Moneydance syncs to your online banking and will automatically download all your transactions. You can also track your credit cards, investment accounts, and all of your bank accounts. Moneydance is a personal finance software that will let you track your budget, manage your debt, and pay your bills online. This article will review Moneydance and talk about how you can get started with this software yourself. It’s ideal for Apple users and many people find it to be a great alternative to Quicken. Moneydance is financial software that lets you manage your budget, bills, debts, and investments on one platform. However, many people (particularly Mac users) have started to look for an alternative to Quicken.

#MONEYDANCE VS QUICKEN HOW TO#

It also intelligently learns how to automatically categorize and sort downloaded transactions so that they are easier to manage. This is useful when it comes to recognizing ledger history and auto-suggesting similar payee entries. Note however that as with all personal finance apps, online banking doesn’t always work. This is often due to security changes on the bank’s side regarding how third party applications access them rather than Moneydance itself. In general though, Moneydance is very reliable when it comes to syncing and downloading online banking and investment house statements.

0 kommentar(er)

0 kommentar(er)